Documentation / cashflow

Documents / CashFlow

| Cash Flow Transactions For Sales Orders | Cash Flow Transactions For Purchase Orders |

|---|---|

| Cash flow settings |

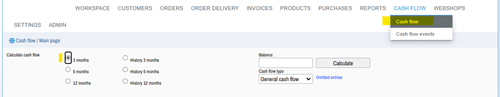

Cash flow is a forecast of future cash flow. Haulbag's cash flow will include transactions from:

Cash flow transactions are exempt from VAT. VAT payments from the accountant can be entered into the cash flow as separate transactions. Transactions in other currencies will be converted to the home currency according to the exchange rates in the program settings.

Not all transactions can be automatically allocated to cash flow, for example. due to missing information. Such transactions can be viewed by clicking the Excluded transactions link above the cash flow statement.

The cash flow can be given the company's account balance, which is taken into account as the starting point of the cash flow. This can be used to monitor e.g. the company's financing needs during a certain period of time.

The cash flow includes all completed, uninvoiced sales orders, as well as the costs of completed sales orders. If the sales order has been delivered in several instalments, the uninvoiced deliveries and undelivered products of the sales order are treated as cash flow for the orders. Invoiced deliveries are processed in the invoice's cash flow transactions, and their value is no longer reflected in the order's cash flow transactions.

Sales orders become one or more cash flow transactions in cash flow, according to the cash flow settings. A sales order is excluded from cash flow if:

Excluded sales orders appear in the Excluded transactions list. Charges on a sales order become a cash flow transaction based on the expense's due date.

The cash flow includes all unpaid invoices from the completed purchase order, as well as the costs of completed purchase orders.

Unpaid invoices on purchase orders are generated into a cash flow transaction according to the due date of the invoice. An unpaid invoice for a purchase order is excluded from cash flow if:

Excluded invoices appear in the Excluded transactions list. Charges on purchase orders become a cash flow transaction based on the expense's due date. A purchase order expense is excluded from cash flow if:

Sales order invoices become one or more cash flow transactions, depending on the cash flow setup. An invoice is excluded from cash flow if the cash flow transaction is defined in the settings from the due date and the invoice does not have a due date. In this case, the invoice will appear in the Excluded transactions list.

Single or recurring transactions can be added to the cash flow. The added transactions appear in the Cash flow entries list. A new event can be created by clicking the Create new link at the top of the list.

The following information is provided for the new cash flow transaction:

A self-defined cash flow transaction may be omitted from the calculation if no amount has been defined for it. In this case, the event will appear in the Excluded events list.

Cash flow calculation rules for orders and invoices are defined in the cash flow settings. Rules are defined for both with the same settings, because the calculation of cash flow for orders and invoices should not differ from each other.

An order and an invoice can become multiple cash flow transactions. The number and timing of events depends on your settings. Each setup line creates its own transaction in the cash flow. The following information is defined in the options bar:

The percentage of the transaction in the total order/invoice value.

The action from which the time of the cash flow transaction is calculated.

+day The number of days to be added to the measure to result in the time of the cash flow transaction.

The company uses a financing company for its invoices. The finance company pays 80% the next day, and the remaining 20% 45 days after the invoice is generated. Two lines are defined in the settings:

The company wants orders and invoices to arrive in cash flow in full according to the due date. One line is defined in the settings: